Real Estate Cycle: Unraveling the Power of Market Trends

The real estate cycle is a fundamental concept that every investor, homeowner, and real estate professional should understand. It’s a pattern that unfolds over time, reflecting the fluctuating health of the real estate market. This article delves into the intricacies of the real estate cycle, offering insights that can help you navigate this ever-changing landscape.

The Concept of Real Estate Cycle

The real estate cycle is a fundamental concept in the real estate industry, reflecting the periodic and cyclical nature of the market. It’s a pattern that unfolds over time, influenced by a variety of economic factors such as interest rates, employment levels, and overall economic growth. Understanding this cycle is crucial for investors, homeowners, and real estate professionals as it can provide valuable insights into market trends and potential investment opportunities.

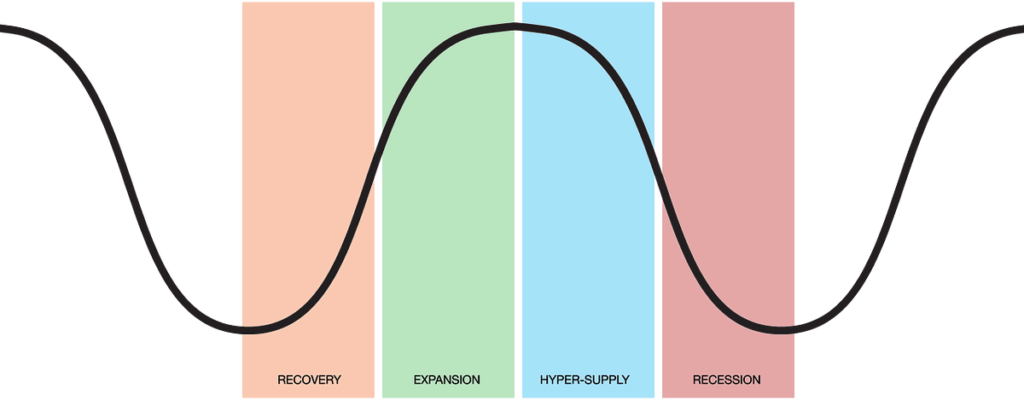

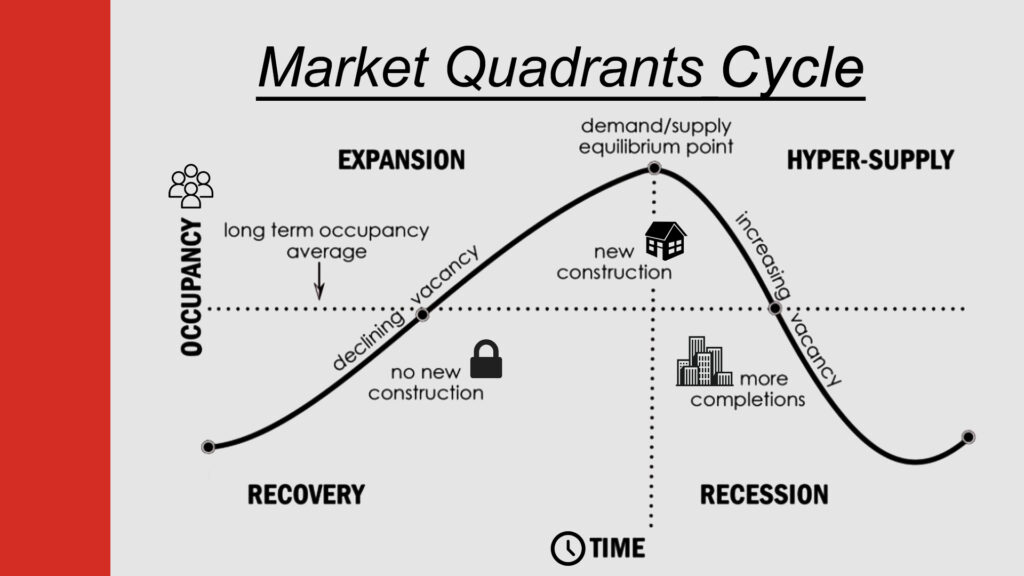

The real estate cycle is typically divided into four distinct stages: recovery, expansion, hyper supply, and recession. Each stage is characterized by different market conditions and indicators.

The Real Estate Cycle Chart: A Visual Representation

| Stage | Characteristics |

|---|---|

| Recovery | Low demand, low prices, high vacancy rates |

| Expansion | Increasing demand, rising prices, decreasing vacancy rates |

| Hyper Supply | Oversupply, falling prices, increasing vacancy rates |

| Recession | High supply, low demand, low prices, high vacancy rates |

The Four Stages of the Real Estate Cycle

Recovery

The recovery stage is the first stage of the real estate cycle, following a period of recession. During this stage, demand for real estate begins to increase, but at a slow pace. Prices are typically low, and there’s a high vacancy rate. This stage is often seen as a period of opportunity for investors, as properties can often be purchased at lower prices.

Expansion

The expansion stage is characterized by a significant increase in demand for real estate. Prices start to rise, and vacancy rates decrease. New construction often begins during this stage, as developers seek to capitalize on the increasing demand. This stage is often seen as a period of growth and prosperity in the real estate market.

Hyper Supply

The hyper supply stage occurs when the supply of real estate begins to exceed demand. This can happen when too much new construction takes place during the expansion stage. Prices may start to fall, and vacancy rates may start to increase. This stage is often seen as a period of caution, as the market may be heading towards a downturn.

Recession

The recession stage is characterized by a high supply of real estate and low demand. Prices are typically low, and there’s a high vacancy rate. This stage is often seen as a challenging period for the real estate market, but it also presents opportunities for investors who are able to purchase properties at lower prices.

Understanding these stages and their characteristics can help individuals and businesses make informed decisions about buying, selling, or investing in real estate. By recognizing the signs of each stage, one can anticipate potential market shifts and act accordingly.

The History of Real Estate Cycles

The history of real estate cycles provides a fascinating insight into the ebb and flow of the property market over time. These cycles have been observed for centuries and are an integral part of economic history.

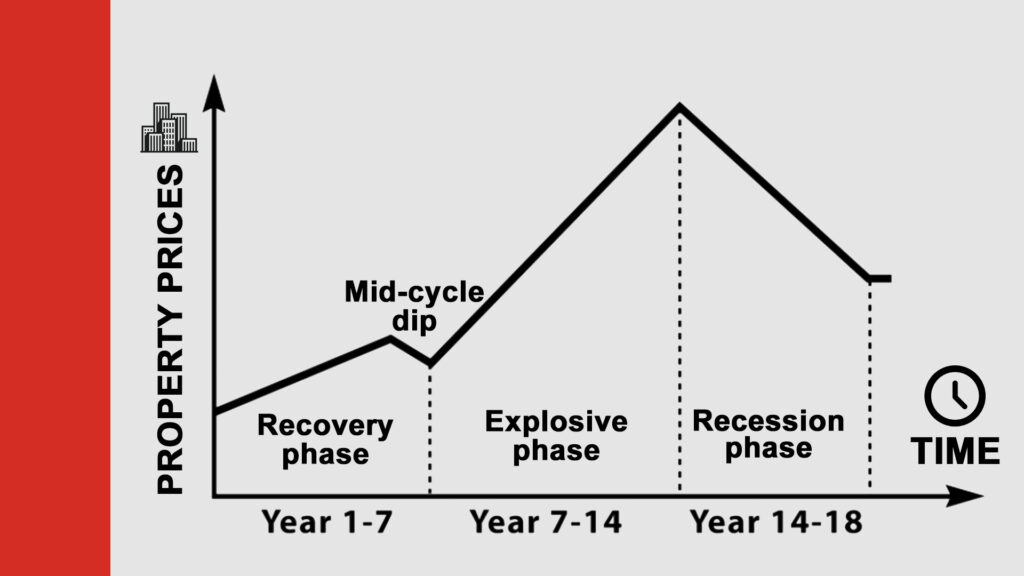

Historically, real estate cycles have been observed to last approximately 18 years, though this is not a hard and fast rule. This theory, often referred to as the “18-year cycle,” was popularized by economist Fred E. Foldvary, who noted that significant real estate booms and busts seemed to occur every 18 years in the United States.

Case Studies: Real Estate Cycle 2016 and Real Estate Cycle 2018

To gain a deeper understanding of the real estate cycle, it can be helpful to examine specific case studies. In this section, we’ll delve into the real estate cycles of 2016 and 2018, highlighting the unique characteristics and market conditions of each period.

Real Estate Cycle 2016

In 2016, the U.S. real estate market was in the recovery stage following the aftermath of the 2008 financial crisis. The recovery was characterized by a slow but steady increase in property prices, a decrease in vacancy rates, and a gradual rise in demand for housing.

During this period, investors who recognized the signs of recovery were able to capitalize on the market conditions. Properties were still relatively affordable, and the rising demand indicated that prices were likely to increase in the coming years. As a result, many investors purchased properties in 2016, which they were able to sell for a profit during the subsequent expansion stage.

Real Estate Cycle 2018

By 2018, the U.S. real estate market had entered the expansion stage. This stage was characterized by a strong demand for housing, rapidly increasing property prices, and low vacancy rates. New construction projects were also on the rise, as developers sought to capitalize on the high demand for housing.

However, by the end of 2018, signs of the hyper supply stage began to emerge. Property prices reached a peak, and the rate of price increase started to slow down. Additionally, the supply of new housing started to exceed demand, leading to an increase in vacancy rates.

Investors who recognized these signs were able to adjust their strategies accordingly. Some chose to sell their properties to take advantage of the high prices, while others held off on new investments in anticipation of the upcoming recession stage.

These case studies highlight the importance of understanding the real estate cycle. By recognizing the signs of each stage, investors can make informed decisions that align with market conditions, maximizing their potential for profit and minimizing risk.

The 18-Year Real Estate Cycle: Myth or Reality?

While the 18-year cycle theory is compelling, it’s important to note that it’s not a definitive rule. Many factors can influence the length and severity of each stage of the real estate cycle, including government policies, economic conditions, and global events.

For example, the 2008 global financial crisis had a significant impact on the real estate cycle, leading to a prolonged recession stage in many markets. Similarly, government policies aimed at stimulating the housing market can accelerate the recovery or expansion stages.

In conclusion, while the history of real estate cycles can provide valuable insights and patterns, it’s essential to consider the unique factors influencing each cycle. Understanding these nuances can help investors, homeowners, and real estate professionals make informed decisions.

The Real Estate Market Cycle

The real estate market cycle is a crucial concept that reflects the state of the real estate market at any given time. It’s closely tied to the broader economic cycle and is influenced by a variety of factors, including interest rates, employment levels, and overall economic growth. Understanding this cycle is essential for anyone involved in the real estate market, as it can provide valuable insights into market trends and potential investment opportunities.

The real estate market cycle is typically divided into four stages, similar to the real estate cycle: recovery, expansion, hyper supply, and recession. However, while the real estate cycle focuses on the supply and demand dynamics of the real estate market, the real estate market cycle also considers broader economic factors.

The Relationship Between the Real Estate Market Cycle and the Broader Economic Cycle

The real estate market cycle is closely tied to the broader economic cycle. During periods of economic growth, demand for real estate typically increases, leading to the expansion stage of the real estate market cycle. Conversely, during periods of economic downturn, demand for real estate often decreases, leading to the recession stage of the cycle.

Factors Influencing the Real Estate Market Cycle

Several factors can influence the real estate market cycle:

- Interest Rates: Lower interest rates can stimulate demand for real estate, as it becomes cheaper to borrow money to buy property. This can lead to the expansion stage of the cycle. Conversely, higher interest rates can dampen demand, potentially leading to the recession stage.

- Employment Levels: Higher employment levels often lead to increased demand for real estate, as more people have the financial stability to buy property. This can contribute to the expansion stage of the cycle.

- Economic Growth: Strong economic growth can stimulate demand for real estate, leading to the expansion stage of the cycle. Conversely, economic downturns can decrease demand, leading to the recession stage.

How to Use the Real Estate Market Cycle to Make Informed Investment Decisions

Understanding the real estate market cycle can help investors make strategic decisions. For example, during the recovery and expansion stages, when demand for real estate is increasing, it may be a good time to invest in property. Conversely, during the hyper supply and recession stages, when demand is decreasing, it may be a good time to sell or hold off on new investments.

In conclusion, the real estate market cycle is a powerful tool for understanding the state of the real estate market. By understanding this cycle, investors, homeowners, and real estate professionals can make informed decisions that align with market trends.

The Real Estate Sales Cycle

The real estate sales cycle is a crucial concept for real estate professionals, particularly those involved in selling properties. It refers to the process that a property goes through from the time it is listed for sale to the time the sale is closed. Understanding this cycle can help real estate professionals navigate the sales process more effectively and achieve better outcomes.

The Real Estate Sales Cycle Phases:

Listing

The cycle begins when a property is listed for sale. This involves determining a competitive price for the property, preparing the property for viewings, and marketing the property to potential buyers.

Negotiation

Once a potential buyer is interested in the property, the negotiation stage begins. This involves discussions about the price and terms of the sale. The goal is to reach an agreement that is acceptable to both the buyer and the seller.

Contract

After an agreement is reached, a contract is drawn up and signed by both parties. This contract outlines the terms of the sale, including the price, the closing date, and any conditions that must be met before the sale can be finalized.

Closing

The closing stage is the final step in the real estate sales cycle. This is when the property is officially transferred from the seller to the buyer. The buyer pays the agreed-upon price, and the seller hands over the keys to the property.

The Relationship Between the Real Estate Sales Cycle and the Real Estate Cycle

The real estate sales cycle is influenced by the broader real estate cycle. For example, during the expansion stage of the real estate cycle, when demand for real estate is high, properties may sell quickly and for higher prices. Conversely, during the recession stage, when demand is low, properties may take longer to sell and may sell for lower prices.

Strategies for Navigating the Real Estate Sales Cycle at Different Stages of the Real Estate Cycle

Understanding the relationship between the real estate sales cycle and the real estate cycle can help real estate professionals develop effective strategies. For example, during the expansion stage, they might focus on marketing properties to a wide audience to take advantage of high demand. During the recession stage, they might focus on pricing properties competitively and targeting serious buyers.

In conclusion, the real estate sales cycle is a vital concept for real estate professionals. By understanding this cycle and how it interacts with the broader real estate cycle, they can navigate the sales process more effectively and achieve better outcomes.

Predicting the Real Estate Cycle

Predicting the real estate cycle is a complex but crucial task for investors, real estate professionals, and economists. Accurate predictions can inform strategic decisions, such as when to buy or sell properties, when to develop new projects, and how to manage real estate portfolios.

However, predicting the real estate cycle is not an exact science. It involves analyzing a wide range of economic indicators, understanding historical trends, and making educated guesses about future market conditions.

The Challenges and Limitations of Predicting the Real Estate Cycle

Predicting the real estate cycle comes with several challenges and limitations. Firstly, the real estate market is influenced by a multitude of factors, including interest rates, employment levels, economic growth, government policies, and even global events. The interplay between these factors is complex and can be difficult to predict accurately.

Secondly, while historical trends can provide valuable insights, they do not guarantee future performance. Each real estate cycle is unique and can be influenced by new and unforeseen factors.

Finally, the real estate market can be subject to sudden and unpredictable changes, often driven by external events. For example, the global financial crisis of 2008 and the COVID-19 pandemic had significant impacts on the real estate market that were difficult to predict.

Tools and Indicators Used by Professionals to Forecast the Real Estate Cycle

Despite these challenges, professionals use a variety of tools and indicators to make educated predictions about the real estate cycle. These include:

- Economic Indicators: Key economic indicators, such as GDP growth, employment levels, and interest rates, can provide insights into the health of the real estate market.

- Real Estate Market Data: Data on housing prices, sales volumes, and inventory levels can help identify trends and predict future market conditions.

- Historical Trends: Analysis of past real estate cycles can provide valuable insights into potential future trends.

The Role of Real Estate Cycle Charts in Predicting Future Trends

Real estate cycle charts are a valuable tool for predicting the real estate cycle. These charts visualize the stages of the real estate cycle over time, helping to identify patterns and trends. By comparing current market conditions with historical data, professionals can make educated predictions about the future of the real estate market.

While predicting the real estate cycle is a complex task, it is a crucial part of strategic decision-making in the real estate industry. By understanding the challenges and using the right tools, professionals can make educated predictions that inform their strategies and decisions.

Practical Applications of Understanding the Real Estate Cycle

Understanding the real estate cycle has numerous practical applications for investors, homeowners, and real estate professionals. It can inform strategic decisions, help manage risks, and identify opportunities in the real estate market.

Informing Buying, Selling, and Investing Decisions

One of the most significant applications of understanding the real estate cycle is informing buying, selling, and investing decisions. For example, during the recovery and expansion stages of the cycle, when demand is increasing and prices are likely to rise, it may be a good time to buy or invest in real estate. Conversely, during the hyper supply and recession stages, when demand is decreasing and prices may fall, it might be a good time to sell or hold off on new investments.

Risk Management

Understanding the real estate cycle can also help manage risks. By recognizing the signs of each stage of the cycle, investors and real estate professionals can anticipate potential market downturns and take steps to protect their investments. For example, during the hyper supply stage, they might choose to sell properties or reduce their exposure to the real estate market to avoid potential losses.

Identifying Opportunities

Finally, understanding the real estate cycle can help identify opportunities in the real estate market. For example, during the recession stage, when prices are low, investors might find opportunities to buy properties at a discount. Similarly, during the expansion stage, developers might find opportunities to start new projects to meet increasing demand.

Case Studies of Successful Real Estate Decisions

There are numerous case studies of successful real estate decisions informed by the real estate cycle. For example, many successful real estate investors have used their understanding of the cycle to buy properties during the recession stage and sell them during the expansion stage, earning significant profits.

In conclusion, understanding the real estate cycle is a powerful tool for anyone involved in the real estate market. It can inform strategic decisions, help manage risks, and identify opportunities, ultimately leading to better outcomes in the real estate market.

Conclusion

Understanding the real estate cycle is a powerful tool for anyone involved in the real estate market. As we look to the future, it’s clearthat this cycle will continue to play a significant role in shaping the real estate landscape. By staying informed and understanding these cycles, you can make strategic decisions that align with market trends.